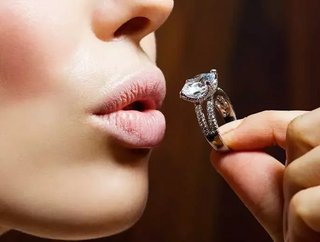

U.S demand for diamond jewellery exceeds $40billion

Total diamond jewellery demand from US consumers increased 4.4 per cent in 2016 to exceed US$40 billion for the first time, according to industry insight data published today by De Beers Group.

While slower US GDP growth in the first quarter of 2017 is likely to have impacted diamond jewellery demand in the short term, the US has recorded five years of consecutive demand growth. US consumers now account for roughly half of all diamond jewellery purchases globally – a level not seen since before the financial crisis.

Although bridal diamond jewellery continues to be the foundation of demand in the US, more frequent acquisitions and a higher value of spend from single women helped drive demand. Meanwhile, self-purchase trends increased among both single and married women.

Fifty-seven per cent of self-purchased diamond jewellery is acquired by married women, while a third is from Millennials. Retailers also reported high levels of consumer interest for multi-diamond pieces.

The data showed that consumers are spending more per piece on diamond jewellery, with retailers reporting an increase in the US$1,000 to US$4,999 category.

Globally, demand for diamond jewellery in 2016 increased marginally in US dollars (at actual exchange rates) to US$80 billion, with demand growth from the US offsetting a contraction in India.

- Demand from Chinese consumers grew 0.6 per cent in local currency and has continued to improve in early 2017, with robust sales around Chinese New Year contributing to the positive performance in the first quarter.

- Demand from Indian consumers started to return to more normal levels in 2017, following an 8.8 per cent contraction (in local currency) in 2016 due to the jewellers’ strike, demonetisation and exchange rates.

- Demand from Japanese consumers declined 2.9 per cent in local currency in 2016, but growth in US dollars reached 8.1 per cent due to the strength of the Yen.

- Demand in the Gulf was impacted by a challenging macro-economic environment, driven by continued oil price weakness.

Further marginal global growth in diamond jewellery demand (in US dollar terms) is likely in 2017.

Bruce Cleaver, CEO, De Beers Group, said: “American consumers continue to express strong desire for diamonds, but their purchasing habits are changing rapidly. While bridal diamond jewellery remains fundamental, we are seeing both single and married women buying for themselves more frequently and more purchases being made online. Meanwhile, products such as multi-diamond jewellery are becoming more popular.

“However, while US demand drove global growth in 2016, it is increasing demand from emerging markets that is behind the last five years being the strongest on record. Despite some markets facing challenging conditions last year, we see this trend continuing, with improvements in demand from China and India, in particular, emerging in 2017.”

- Diamonds (and uranium) are Namibia’s best friendOperations

- Rajant & Sandvik partner on De Beers' Venetia Diamond MineAutomation & AI

- Mountain Province Diamonds announces record quarter resultsSupply Chain & Operations

- Anglo American production drops 10% but diamonds rise 25%Supply Chain & Operations