GCM Mining and Aris Gold form leading Americas gold producer

GCM Mining Corp. and Aris Gold Corporation have entered into a definitive agreement under which GCM will acquire all the outstanding Aris Gold shares not already held by GCM.

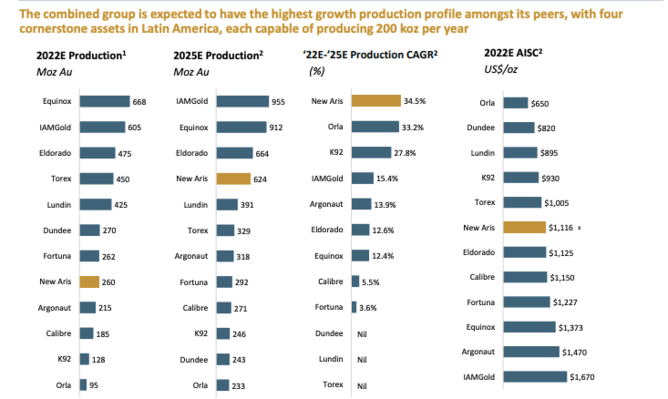

The resulting entity will be named Aris Gold Corporation and led by Ian Telfer as Chair and Neil Woodyer as CEO and Director, offering a combined gold reserve of 3.8Moz, resource base of 18Moz Measured & Indicated and 7.7Moz Inferred. Joining forces creates the largest gold company in Colombia, with diversification in Guyana and Canada.

Ian Telfer, Aris Gold Chair, said: "After Aris Gold became operator of the Soto Norte joint venture, joining forces with GCM became a logical next step. Our increased scale will also broaden our future opportunities to continue building a +1 million ounce producer over the next few years."

Estimated G&A cost savings will be around $10mn per year through the reduction of duplicative public company expenses and rationalising other expenses.

Serafino Iacono, Executive Chair of GCM, said each team has distinctive strengths with GCM being the Colombian leader for responsible, sustainable mining practices.

"Together with Aris Gold's Board and management, the combined group brings a track record of building sizable and successful mining companies; this transaction further diversifies the company's portfolio and reaffirms Colombia as an area of focus." While stepping down from a day-to-day executive role, heI will remain a director and advisor on matters in Colombia.

Neil Woodyer, CEO of Aris Gold, said it is building a gold mining business with scale, cash flow, a strong financial position with $397mn cash and $260mn additional committed funding, and a high-'quality' growth pipeline. "Our teams are well known to each other, and together we will optimise the delivery of the growth projects," he said.

All outstanding Aris Gold shares not held by GCM will be exchanged at a ratio of 0.5 of a common share of GCM for each common share of Aris Gold.

The Exchange Ratio was determined at-market giving consideration to the 10-day and 20-day volume weighted average prices on the TSX for each of GCM and Aris Gold for the period ended July 22, 2022.

Both the GCM and Aris Gold Boards of Directors have approved the terms of the Arrangement Agreement, and all of the directors and officers of both GCM and Aris Gold have entered into binding voting support agreements in favour of the transaction, representing in aggregate 3% of GCM's issued shares and 9% of Aris Gold's issued shares.