Copper production from top ten companies to increase by 3.8%

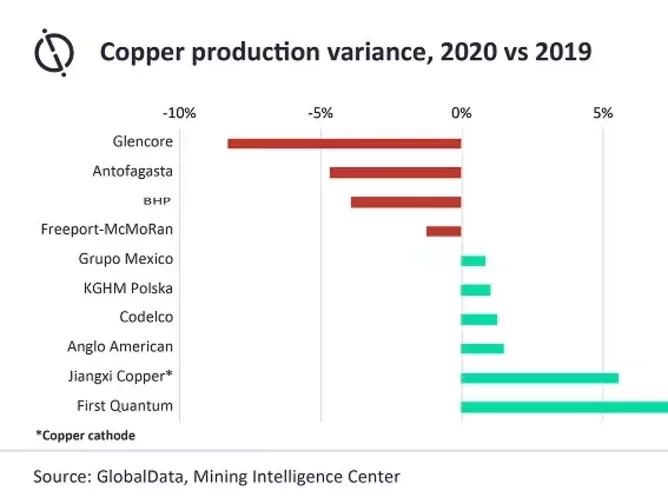

Copper production from the world’s top companies is set to increase by up to 3.8% this year, following a fall of 0.2% in 2020, GlobalData analysis reveals. Last year’s marginal slump saw production drop to 11.76 million tonnes (Mt).

Copper

The initial impact of the COVID-19 pandemic on mining operations was immense, however, six of the ten largest copper producers succeeded in increasing output last year. In 2021, copper production from the top ten copper companies is expected to bounce back, rising by up to 3.8%, to reach 12.2Mt, according to GlobalData, a leading data and analytics company.

First Quantum

The highest increase in copper production was by Canada’s First Quantum, which, despite all the challenges, reported 10.4% growth in 2020. The company’s Sentinel mine in Zambia and Cobre Panama were key contributors to this growth. While the latter remained under care and maintenance between April and August 2020, it delivered record production levels during the subsequent months.

Codelco

Codelco, the world’s largest producer of the red metal used in electric vehicles, also bucked the trend.

Vinneth Bajaj, Associate Project Manager at GlobalData, commented: “Despite Codelco reporting over 3,400 active cases during July 2020, the company achieved 1.2% growth in its production in 2020. The company implemented a four-phase plan, as part of the COVID-19 measures, to ensure the health and safety of its employees, while also avoiding any significant impact to its copper output.”

Freeport McMoRan

Although the overall impact was minimal, declines in production were observed from Glencore (8.2%), Antofagasta (4.7%), BHP (3.9%) and Freeport McMoRan (1.3%). Reduced operational workforces due to COVID-19 measures, lower ore grades and production halts due to maintenance were the key disruptors to output during 2020.

Electric Vehicles

The move towards electric vehicles and clean energy from renewables sources such as solar panels and wind turbines has driven the copper price to all-time highs. Copper has been among the best performers over the last month where metals ranging from aluminum to iron ore have surged to their highest prices in years. The rally is being fueled by stimulus measures, near-zero interest rates and signs that economies are recovering from the global pandemic.

- Gécamines & Ivanhoe Restart Kipushi Zinc-Copper-Silver MineSupply Chain & Operations

- First Quantum contracts with MECS to cut emissionsSupply Chain & Operations

- Report predicts a looming copper supply gapSupply Chain & Operations

- Ivanhoe founder says copper prices could jump tenfoldSupply Chain & Operations