AfriTin Uis mine lithium results 'exceed expectations'

AfriTin Mining reports that results for the lithium and tantalum drilling programme at its flagship operation, the Uis tin mine in Namibia, have exceeded expectations.

Significant V1/V2 pegmatite intersections include:

- 132m at 0.168% Sn, 75 ppm Ta, and 0.74% Li2O for drill hole V1V2049, from 124m to 256m;

- 110m at 0.171% Sn, 92 ppm Ta, and 0.75% Li2O for drill hole V1V2057, from 92m to 202m;

Pegmatite intersected in all holes at depths and apparent widths as predicted by the geological model. Notable intersections of lithium mineralisation within the pegmatite include:

- 8m at 1.08% Li2O for drill hole V1V2036, from 140m to 148m;

- 10m at 1.05% Li2O for drill hole V1V2045, from 136m to 146m;

- 12m at 0.99% Li2O for drill hole V1V2049, from 231m to 243m;

- and 45m at 1.04% Li2O for drill hole V1V2057, from 136m to 181m.

CEO Anthony Viljoen said the results reinforce its belief that Uis is host to "one of the largest lithium resources globally".

"While the V1/V2 pegmatite displays impressive dimensions and is open-ended at depth, a multitude of surrounding pegmatites present significant upside potential," he said.

"As a former mining operation, Uis has been extensively drilled but historic assaying has focused solely on the tin with no regard for the lithium or tantalum in the deposit. This programme will increase the confidence of the current lithium and tantalum estimates and is part of our strategy to bring these two commodities into production alongside our tin operation."

The construction of a new lithium pilot plant will allow the company to progress to commercial production phases much faster than a new greenfield lithium resource elsewhere, the statement added.

Uis mine in focus

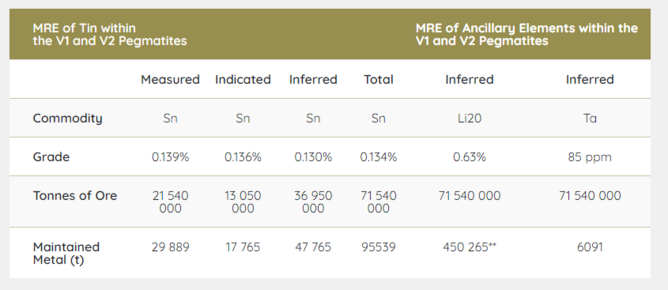

Profitable pilot plant is in full operation. Nameplate production of 720tpa has been achieved and the plant is profitable on tin alone.

Significant by-product potential from lithium and tantalum and the Phase 2 expansion of tin concentrate production to 1300tpa makes this a dramatically scalable project with potential to also become a global lithium supplier.

- > 180 mineralized pegmatites mapped within 5 km of the current operation

- Same mineralogical composition – typical Uis pegmatites

- Near surface intersection of 67 m on W17 pegmatite

- Significant resource upside potential

Other AfriTin projects include Brandberg West, Nai-Nais and B1C1.

Mining contributes around 25% to Namibia's GDP. Alongside lithium it contains diamonds, uranium, copper, gold, lead, tin, cadmium, zinc, salt and vanadium.

Meanwhile Bolivia has narrowed the list of competing foreign firms vying to tap its vast lithium resources to six, according to energy minister Franklin Molina, part of the country's most ambitious efforts to extract the metal, states a Reuters report.

- Focus on: Lithium – ‘White Gold’ Driving the EV RevolutionSupply Chain & Operations

- Exyn Nexys: Real-time 3D Mapping for Mining SurveyorsDigital Mining

- Can Retrofitting Vehicles Boost Efficiency & Sustainability?Sustainability

- Mina Justa boosts mine safety using StraconTech IoT solutionTechnology