[INFOGRAPHIC] Australia, Brazil controlling Chinese supply of iron ore

Despite demand for iron ore in steady decline in China, its share of imports from top mining countries such as Australia and Brazil continues to increase.

According to data from General Administration of Customs, China imported 453.1 million metric tons of iron ore in the first six months of 2015 with 83 percent of it coming from either Australia or Brazil. That is an increase of 74 percent from the same time period in 2014.

RELATED TOPIC: LNG surpassing coal and iron ore in Australia

Mining giants Vale, Rio Tinto, BHP Billiton and Fortescue Metals Group each reported increased output in its second-quarter results from April-June. However, the output of iron ore from smaller mining companies has taken a steep fall.

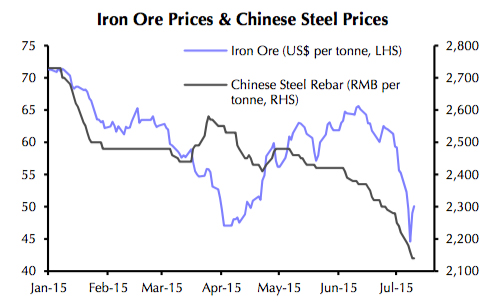

The Platts IODEX CFR China price of iron ore was recently assessed at $56.75/Dry Metric Tons (dmt), which is up from a record low of $44.50/dmt earlier in July as the market finally stabilized. Many believe the drop was due to recent chaos on Chinese equity markets.

RELATED TOPIC: Iron ore prices fall into danger zone

When the price dips below $50, it’s often much more difficult for smaller mining companies to survive.

As a result of the fluctuation, supply from smaller miners has become far less stable. Although some of the major steel mills would rather purchase from top miners, others continue to work out negotiations with the smaller companies

RELATED TOPIC: Top 10 Iron ore producers based on 2015 guidance

Miners both large and small have begun searching for way to cut costs any way they can due to weak low prices and China’s weakening demand. A slowing economy and property market has cut China’s steel usage by over five percent during the first five months of 2015.

With a crackdown on China’s most polluting industries along with little hope of an increase in demand, things look quite bleak for the industry for the remainder of the year.