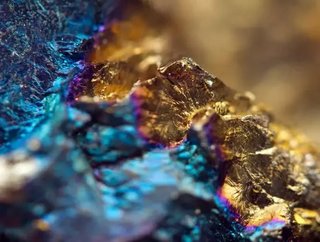

Global supply and demand for platinum to remain in balance in 2018

The global supply of platinum is predicted to fall in 2018, but industry and jewellery demand is expected to rebound.

A report published the World Platinum Investment Council (WPIC) has revealed that the supply and demand for platinum will be closely matched in 2018, bringing the market back ti a state of “equilibrium.”

Global platinum supply is forecast to be 7,815 koz in 2018, a decline of 2% from 2017, despite an anticipated increase in recycling of 60 koz to 1,965 koz. Total mining supply for 2018 is expected to decline by 4% to 5,850 koz.

The declining total mining supply is attributable to a reduced output of the metal from South Africa due to mine closures in 2017 as well as a significantly lower production level in Russia.

The demand for platinum is expected to grow, only somewhat marginally. Figures show that for 2018, there will be a demand of 7,790 koz of platinum which signals a rebound in industrial demand and an increase in jewellery demand.

These two areas will significantly outweigh declining figures in the automotive industry as well as “slightly lower” investment demand.

“While 2017 was a challenging year for platinum, early indications show signs of a market that is moving in the right direction in 2018. Supply is tightening and demand remains resilient. These promising fundamentals, paired with elevated global uncertainty and a better economic growth outlook, mean macro conditions are becoming increasingly helpful to the platinum market,” said Paul Wilson, chief executive officer of WPIC.

Related stories:

Cameo Resources acquires Copper-Cobalt-Nickel Property amidst electric battery surge

Mining and metal deals reached $51 billion in 2017

BlueRock Diamonds: The junior diamond miner with global ambitions

42% of Australian mining leaders to increase spending in 2017-2018

“While concerns about automotive demand weigh negatively on platinum sentiment, we believe that these concerns are, once again, overdone. The policy environment for diesel vehicles remains in flux, especially in Europe. Nevertheless, our broad perspective, including the environmental need to reduce CO2 emissions, significant hurdles to mass battery electric vehicle adoption, and automakers already able to genuinely clean up diesel NOx emissions, means we firmly believe clean diesel vehicles will be on the road for years to come.”